For anyone sitting back and taking note of reported metrics such as business confidence, unemployment rates, GDP growth, record real estate sales and new home builds, or looking at the share market reaching new highs, it’s hard to believe we are approaching 2 years of pandemic induced lockdowns, writes Tim Roberts, managing director of TR Consulting.

However, these numbers have significant limitations and if you dig a little deeper, the true health of the economy can be uncovered. Let’s take a few for example…

The headline unemployment rate has dropped to its lowest level in 12 years, sitting at what seems to be a healthy 4.5 percent. However, the ABS figures also noted 146,300 jobs were lost over the period. Doesn’t make sense, right? It is more accurate to look into the hours worked nationally, which fell by 3.7% over the same period (13% in NSW since the start of the current wave of lockdowns). The underemployment rate increased to 9.3%, meaning a total of 66 million hours of work was lost. So, what does this mean? Put simply, people are dropping out of the race to look for work as a result of the difficulties of doing so in the current, challenging climate.

We recently avoided a technical recession when the GDP scraped out a 0.1% rise in the second quarter. However, this was largely manipulated by the increase in government spending and our ever-growing dependence on the resources sector. Take out these factors, and the pain being felt by most small to medium-sized businesses would be more accurately represented.

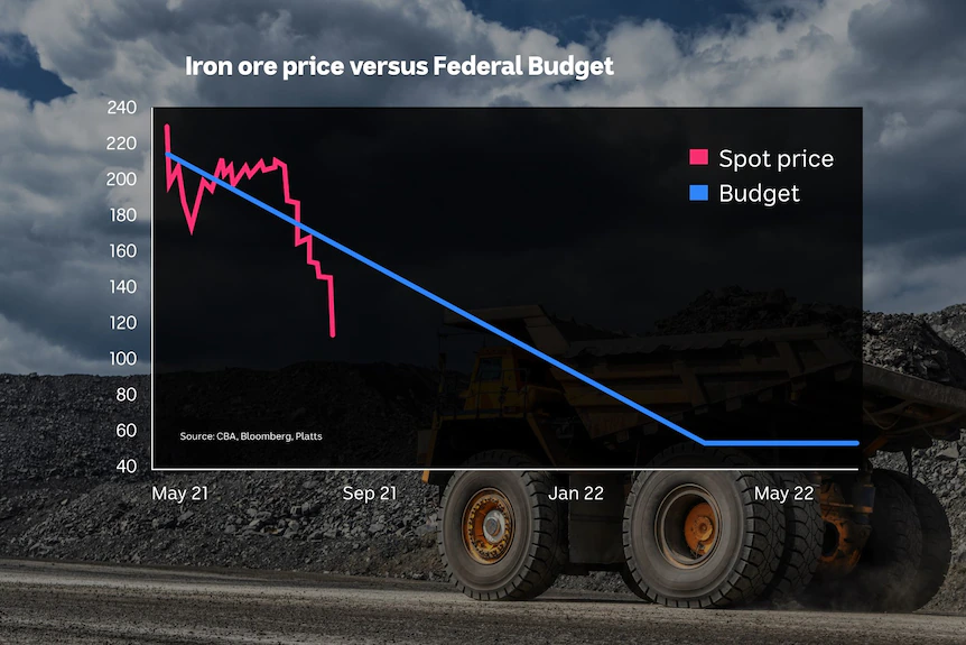

The government’s budget is dependent on the iron ore price holding up to cover the weaknesses expected in most industries. However, as seen in the below graph, the spot price has already retreated in free fall from recent highs and is trading well below the budgeted assumptions for iron ore prices. We avoided the recession for now but for how long?

I have the benefit of working with a wide cross-section of Victorian businesses at the coalface. The clients we work with range from startups to established businesses turning over $100m a year. Unlike the previous lockdowns of 2020 and earlier in 2021, the current lockdown is pushing under-resourced businesses to the brink.

Small business operators have been forced to take on numerous roles in the business as there simply is a lack of sales to cover wages. The hardest thing to mitigate when running a small business is uncertainty. As we wait for the Victorian Government to announce its road map out of recovery, unfortunately, it will be too late for many business operators. Sometimes the easiest way to assess the true state of the economy is to take a walk down your local strip of shops. No longer is it normal to see 1 or 2 for lease, but now some strips have every 3rd shop vacant and sadly, no one should be surprised.

It is hard not to see the pandemic as a tale of two opposing halves. In the first nine months, the Federal Government swiftly developed and implemented core measures such as the JobKeeper Program, which delivered funding of approximately $90bn to 920,000 organisations, and benefited over 3.8 million individuals. The effective hurdle to participate in the program was to demonstrate sales had been negatively impacted by 30% or more.

Other material measures included the Cashflow Boost ($35bn) and various State Government support payments and policies such as the COVID-19 rent relief scheme which ensured landlords worked with tenants and shared a proportionate drop in commercial rents payable to businesses unable to trade.

At this point, our management of the COVID-19 situation had been world-leading, our deaths per million of people was one of the lowest in the developed world (Australia 44 deaths per million people vs UK 2,100) and the Government measures had kept workers in jobs and businesses able to hibernate for a re-opening in 2021.

However, fast-forward to 2021 and as Victoria entered into its 5th and now 6th lockdown, supports were effectively removed. The stimulus originally designed to keep employees in jobs now encouraged employers to let them go so that they could receive JobSeeker or support now only available to individuals.

Painfully, the lockdowns of 2021 were largely avoidable and the fault has to lie with the Federal Government. Where Australia’s containment of the virus in 2020 was only second to New Zealand, its ability to effectively source, negotiate and deliver the COVID-19 vaccine nationwide was at best 6 months behind our developed country counterparts.

So, if there was ever a period where the Government had to compensate small business for their incompetence in getting vaccines into keen arms, the 5th and 6th lockdowns were it. Instead, businesses are forced to shut their doors, order their staff (if they could stretch cashflows to keep them employed) to work ineffectively from home and have their ability to trade stopped or at least severely limited.

Now, I’m not wanting to make this a battle between New South Wales and Victoria, however it is hard not to. It would appear that the NSW Premier Gladys Berejiklian has only been rewarded for throwing stones at Victoria’s approach in 2020 but then delaying inevitable lockdowns in 2021 in what could only be seen as a vote grabbing move. After all, our current lockdown in Victoria is a direct result of her state’s inability to contain the virus within their own borders.

So, what were the penalties for the handling of this out-of-control wave of infections in NSW? Obviously, they were rewarded with additional vaccines not in proportion to their population, and further, they were rewarded with additional Federal Funding not available to other states. The argument being in totality at the point announced that the funding was fairly split between Victoria and NSW. This is despite the fact that Victorian businesses were slammed shut for significantly longer and they had to endure stricter lockdowns which included only truly essential businesses being open and reduced hours under a curfew. Surely if common sense prevailed, you couldn’t compare government support provided across the two states.

Currently, in Victoria, funding from both a State and Federal Government level is very limited, unless you are operating in a niche industry such as Alpine Resorts. The only widely available business funding requires that your business has suffered a 70 per cent or greater reduction in turnover. Any business that is at this point is not in difficulty, the lights are off. Most small business owners work off a 10 – 15 per cent net profit position to get by and do not have substantial savings or resources available to tap into when a 1 in 100-year pandemic arises. Non-business owners may hear the news and headlines about government-backed loans and other such measures, however, the truth is the access of such funds through the major banks is slow and limited.

Unfortunately, the longer the pandemic continues, the less the approach seems to be balanced and proportionate to the other considerations such as mental health, children’s education and providing small business with a realistic path to trade out of the pandemic. There seems to be different rules for politicians and large corporates compared to the rest. However, the Government should remember that small businesses are the life blood of the economy. With over 99 per cent of all businesses in Australia classified as an SME (Less then 200 employees or $10m in revenues) it would be well advised to focus on the companies that are the backbone of the economy, and not on the 1 per cent of big businesses which will no doubt already have the resources to be able to navigate, survive and maybe even thrive their way through this pandemic…

This post originally appeared on TR Consulting and is republished with permission. You can read the original here.

Want more? Get the latest coronavirus news and updates straight to your inbox! Follow Kochie’s Business Builders on Facebook, Twitter, Instagram, and LinkedIn.

Now read this

Trending

Weekly business news and insights, delivered to your inbox.